When profiling customers, salary is a major determinant that influences how much of a credit line the customer can be approved for. Credit lines are important because they provide purchasing power, encourage customers to increase spending and extend his/her relationship with the business. It is a win-win situation. This is a mini-case where we will use two data points to determine wages.

We know that usually, a company is not able to directly inquire about how much you make or how old you are (as privacy reigns), but it can surely ask for age range and where you work. So the question is: how can we figure out, based on a couple of attributes, where you stand wage wise, in order to assign high or low credit lines, specially if you are a brand-new customer?

Here is where we apply unsupervised machine learning, a branch of predictive analytics that allows us to place a label on people or things based on patterns or characteristics, and therefore, classify or group new objects without prior knowledge.

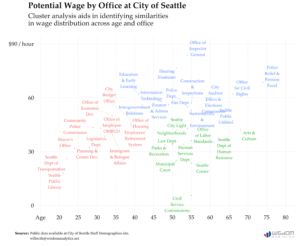

We will use the k-means clustering algorithm to estimate the wage similarities of 11.3k regular, multi-race active employees of the 38 departments at City of Seattle, ranging from 16 to 84 years old. The data were obtained through its Staff Demographics’ website downloaded on October 26th, 2019.

After running the analysis, we identified three clusters (or groups) with similarities in wage based solely on providing two pieces of information.dd description

The clustering plot shows the hourly wage that someone may receive when working at any of these departments and sits within a specific age. One thing I noticed was that departments with the word “police” received higher wages than their counterparts. The red cluster contains the youngest age group, averaging people at 30.9 years old and $38.6 an hour, making, on average, $6.4 more than the green cluster but $21.9 less than the blue one.

The approach above will deliver guidance to credit analysts, finance supervisors and sales executives looking to increase sales, extend footprint and build customer loyalty. Decisions can now be made as to what type of employees can be offered a higher or lower credit line, which ones to market specific products based on price (campaign tailoring and segmentation) and even set price adjustments as a strategic move to capture a broader market share.